- Trades We CoverTrades We Cover

Some insurance brokers don’t know their arch flares from their elbow pipes. Not us. We understand the motor trade covers a vast range of different activities, skills and businesses. That’s why our cover’s tailored to your exact needs.

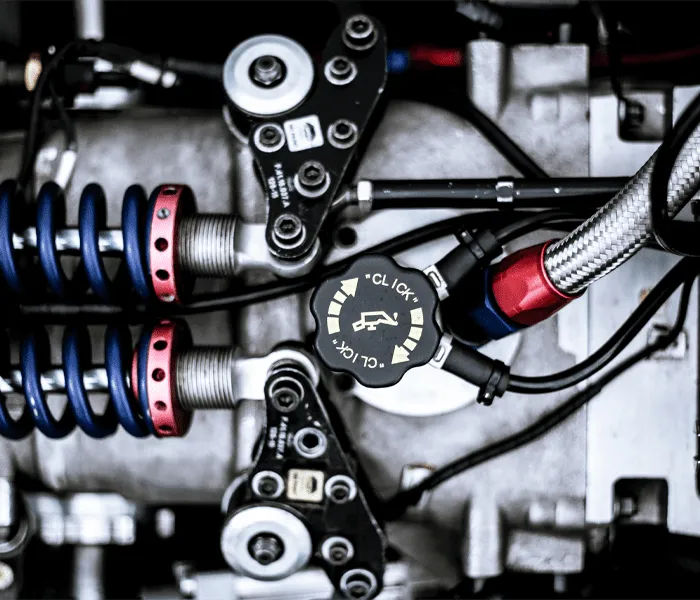

- Auto Electrician InsuranceAuto Electrician Insurance

Auto electricians are a vital part of the motor trade, it’s important that they have the right insurance. Speak to the experts at Road Runner today for a quote!

- Crash Repairs & Bodyshop InsuranceCrash Repairs & Bodyshop Insurance

If you offer crash repairs to your clients, you will need to consider motor trade insurance from Road Runner. Click here to see how we can help your business!

- Mechanic InsuranceMechanic Insurance

With so much time spent on the road, let alone caring for your customers’ vehicles, mechanic liability insurance is worth considering.

- Mobile Mechanic InsuranceMobile Mechanic Insurance

Mobile Mechanic Insurance from the motor trade experts. 25+ years’ experience. Tailored quotes – get your personalised cover today!

- Mechanic Tool InsuranceMechanic Tool Insurance

Get specialist mechanic tool insurance. A dedicated team, UK-wide cover, and protection for your essential tools. Get a quote today.

- Part-Time Motor TradePart-Time Motor Trade

Get tailored part-time motor trade insurance from Road Runner. Comprehensive cover that fits your needs and budget. Get a quote today.

- SMART Repair InsuranceSMART Repair Insurance

Looking for specialised SMART Repair insurance? Road Runner have over 25 years of experience with the motor trade. Get a quote today to see how they can help.

- Trade Plate InsuranceTrade Plate Insurance

Trade Plate Insurance made simple. Flexible, trusted cover for vehicle delivery drivers and professionals handling other people’s vehicles. Get a quote today.

- Exhaust & Tyre Fitter InsuranceExhaust & Tyre Fitter Insurance

Tyre, exhaust and accessory fitting covers a vast range of activities. For some customers, needing a new part comes as an unexpected and unwanted cost – while for others it means spending out on long-planned enhancements to a vehicle they love.

- Car Valeting InsuranceCar Valeting Insurance

Car Valeting Insurance made simple. Get fast, flexible cover for cars and vans with Road Runner. Protect your business – get your personalised quote today!

- Breakdown & Vehicle Recovery InsuranceBreakdown & Vehicle Recovery Insurance

Do you need car and vehicle recovery insurance? We can make sure you’re covered from third-party claims that arise during the breakdown and recovery.

- Recovery Truck InsuranceRecovery Truck Insurance

Keep yourself and your recovery truck protected whether you’re on a repair, on the road, or at your workshop.

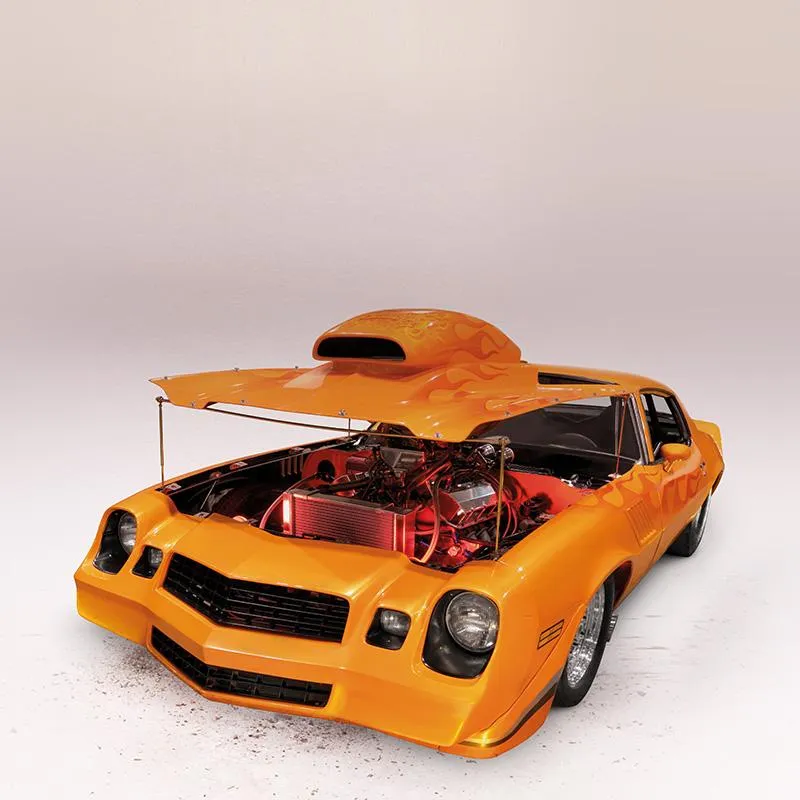

- Vehicle Repairs & ServicingVehicle Repairs & Servicing

If you work in car repairs or servicing, we have your back. Whether you work from home, are based at a premises or operate on a mobile basis, we’re here to help get you the right car servicing insurance to protect you from risk. From Liability insurance to Premises insurance and Road Risks insurance, we can sort it.

- Car Dealer InsuranceCar Dealer Insurance

Protect your dealership with Car Dealer Insurance from Road Runner. Cover for all your vehicles, stock, premises, liability & more. Get a quote today.

- VIEW ALL TRADES WE COVERVIEW ALL TRADES WE COVER

Some insurance brokers don’t know their arch flares from their elbow pipes. Not us. We understand the motor trade covers a vast range of different activities, skills and businesses. That’s why our cover’s tailored to your exact needs.

- Auto Electrician InsuranceAuto Electrician Insurance

- Our ProductsOur Products

From panel beaters to tyre fitters, we understand the range of risks independent motor traders face.

- Road Risks InsuranceRoad Risks Insurance

Get a motor trade road risk policy that works for you with Road Runner. Whether you buy, sell or repair cars for a living, we can get you the right cover.

- Premises InsurancePremises Insurance

Looking to insure your premises and assets? Road Runner have over 25 years of experience with the motor trade. Get a quote today to see how they can help.

- Liability InsuranceLiability Insurance

Motor trade liability insurance protects you and your business against employee claims, accidents, loss of and damage to customer vehicles.

- Road Risks InsuranceRoad Risks Insurance

- Existing CustomersExisting Customers

As one of our customers, you’re our number one priority. Here you should find everything you need to easily manage your account.

- Managing your vehiclesManaging your vehicles

Keep track of your vehicle details easily. Check your cover details and choose the option that applies to you.

- Make a ClaimMake a Claim

Need to make a claim? Contact us ASAP. Our dedicated numbers connect you to the right team.

- Tell a MateTell a Mate

Tell your mates in the motor trade about Road Runner Insurance and you’ll get £50 each if they take out a policy with us.

- DocumentsDocuments

Downloadable PDF Policy Documents

- Win your renewal backWin your renewal back

We know working in the motor trade can be tough at times, so whenever we can make life a little easier, we’ll always try to. That’s why we’re giving you the opportunity to win back your renewal!**

- Managing your vehiclesManaging your vehicles

- BrokersBrokers

If you already have an existing agency with us, simply login. If you’re interested in applying for an agency, read on for more details.

- Apply for an AgencyApply for an Agency

All you need to do is complete our application form.

- Vehicle Management/MID UpdateVehicle Management/MID Update

Keep on top of your clients’ vehicle details quickly and easily with our 24/7 vehicle management portal. Simply check your client’s policy number and date, which you can find on the Certificate of Insurance.

- Account Change RequestAccount Change Request

If you would like to make a change to your online Broker account, please complete and submit the below form.

- Request a Quote BrokersRequest a Quote Brokers

If you are a broker, when it comes to getting a quote from us, you have a couple of options.

- Broker LoginBroker Login

Our new online Road Runner platform provides a quick and simple Vehicle Management solution to ensure the Motor Insurance Database is kept up-to-date

- Road Runner PlusRoad Runner Plus

Introducing Road Runner Plus, designed to be a standard & consistent data capture platform, providing a flexible, combined packaged insurance solution, ideal for your SME motor trade clients requiring a combined package quote.

- Apply for an AgencyApply for an Agency

- News and ViewsNews and Views

The latest news and insight, hints, tips, and other helpful information from the Road Runner motor trade insurance team.

- Contact UsContact Us

We’re here to support you if you need us. And if for any reason we can’t open when we normally would, we’ll always do our best to let you know beforehand.

- FAQsFAQs

Whatever part of the motor trade you work in, we’re here to help you.

- Meet the TeamMeet the Team

Meet the Road Runner team.

- FAQsFAQs

- Managing your vehiclesManaging your vehicles

Keep track of your vehicle details easily. Check your cover details and choose the option that applies to you.

- Contact UsContact Us

We’re here to support you if you need us. And if for any reason we can’t open when we normally would, we’ll always do our best to let you know beforehand.